The volatility of currency means exchange rates are always changing. When I worked as an English teacher in South Korea for a year, I lost thousands by waiting to transfer my earnings back to US dollars. The rate tanked over the year I was there so my millions of won were not worth the same in US dollars when I left as they would have been when I arrived (or at any point along the way). You never know exactly what the rate will be even from day to day. Rates can also differ quite a bit depending on how and where you exchange. So how to get the best value for your hard-earned money while abroad? The only thing you can do is try to get the best exchange rate available at the time. This can be tricky to do and varies by destination but there are some definite dos and don’t that are pretty universal.

XE.com

My favorite resource for the most up to date exchange rate is XE.com. Their rates are live and change immediately as the market changes. Check their website or download the app to get a baseline for the rate you are aiming to equal or better. You can get an idea in advance but double-check the rate again right before you change any money to see if it has altered.

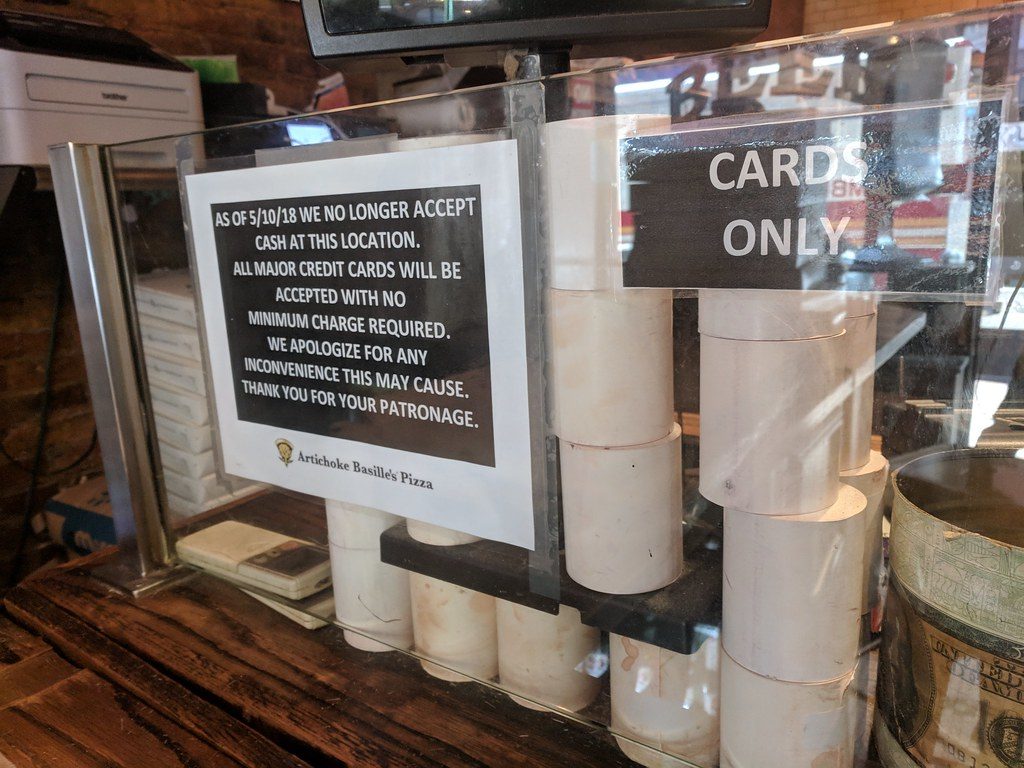

The End of Cash

Do you even need to change any money? I traveled literally around the world for six-months last year and only used cash once – to shop in a local market in Cambodia. And I used US dollars there (my home currency) so I never handled any foreign cash. I’ve seen more and more businesses that don’t even take cash anymore. You must pay by card or the local e-pay method. This makes travel a lot easier, as long as you have a good travel credit card.

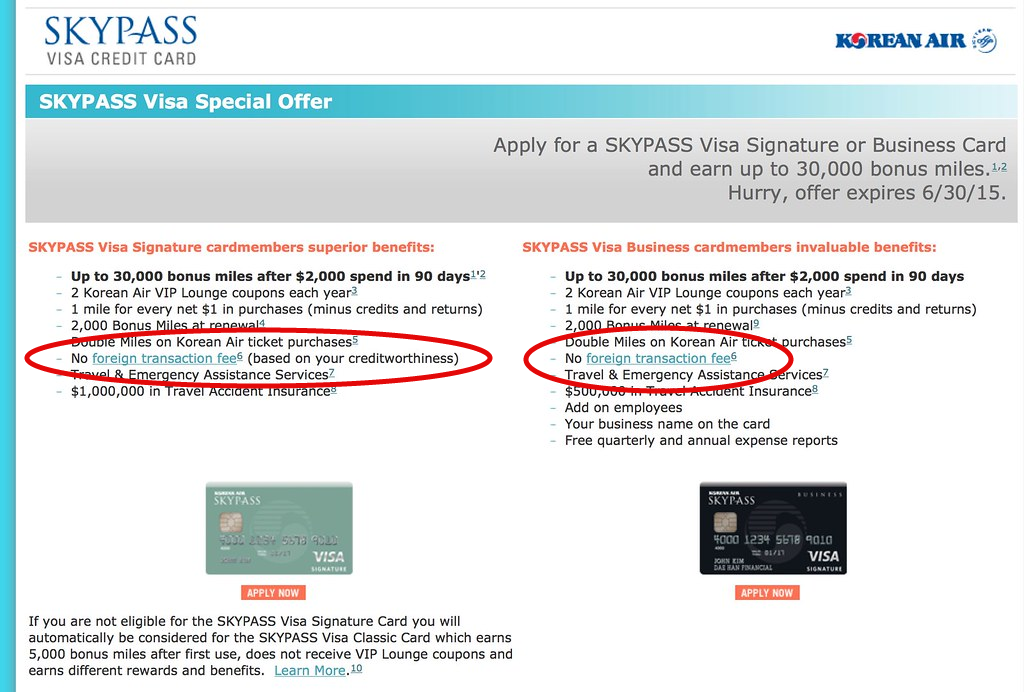

No Foreign Transaction Fees

Credit cards typically give you the best exchange rates. This makes them convenient and the best bargain. However, you need to be aware of not only the rate but additional fees. The most common fee is a Foreign Transaction Fee. This means they charge you 3-5% just to use your card abroad. This doesn’t sound like much, but if you are spending hundreds or thousands on your trip, 5% adds up to quite a bit! Be sure to only use credit cards without foreign transaction fees.

Pay in the Local Currency

When you use a credit card from a different country than the one you are in, the merchant has a choice whether to put the charge through in their local currency or in yours. This is called Dynamic Currency Conversion. You may be tempted to use your home currency because then you know immediately exactly what the cost will be on your statement. Don’t be tempted! Paying in your home currency can end up costing you as much as 18% extra. The dynamic currency conversion service is provided by the merchant or the third-party payment system they use, not by your credit card company. Thus, it is not the same as any currency conversion fee set by your credit card, if your card evens charges a conversion fee at all.

By paying in the local currency, the merchant does not have the opportunity to add this conversion mark-up and the charge will come through with your credit card’s exchange rate. So if you are asked what currency you want to pay in or have a choice on the screen, always choose the local one. Merchants don’t always ask, so don’t be afraid to tell them to use the local currency or to change it if you see your home currency come up.

ATMs All the Way

Of course, there are still some countries or situations where you need to use cash (to shop in the local market, for example). The best way to get foreign cash is by foreign ATMs. They will give you the best exchange rate. Just roll up in your destination, pop your debit card into the nearest ATM, and withdraw foreign cash. I always try to calculate how much cash I expect to need and only take out that amount. It’s a balancing act between being sure you have enough and not having tons leftover that you have to change back at a worse rate.

There are a couple of factors to be aware of with this method. Though it does typically give you the best exchange rate, be sure this is balanced against any Out-of-Network ATM Fees or Currency Conversion Fees your bank may charge. Typically, though, these are pretty small and worth it for the convenience and exchange rate. Definitely check online or ask a local which ATM in the area has the lowest fee or if there is a no-fee ATM nearby. The other factor to consider when using your debit card is daily limits. This probably won’t be a problem for travelers who use credit cards for most things but need a little cash for local shopping or something. If you think you will need lots of cash, however, check if your bank will raise your daily limit. Then you won’t have to keep withdrawing more every day and racking up fees. Many banks will do this if you ask.

Banks Are Next Best

If you just feel better having some of the local currency in your pocket before you arrive in your destination, banks are the next best way to exchange currency. Call around and check if banks in your home area stock the currency you want. If not, they can usually order it pretty quickly. Ask several banks or credit unions what their current exchange rate is for your desired currency and choose the best one. Keep in mind that some banks will only exchange currency for people who have accounts with them, which may limit your options.

Avoid Exchange Booths

The absolute worst way to exchange currency? Exchange booths! Booths in touristy areas and especially in airports and train stations are notorious for terrible exchange rates, high fees, and mark-ups. They can get away with this because they are convenient and are often the first or last chance for travelers to change money. I have, of course, used exchange booths occasionally for these very reasons but only when there was no other option. If you can avoid them, definitely do!

The Bottom Line

Basically, you will get the best exchange rates and incur the least extra fees by paying with your credit card in the local currency. Plus, it’s the easiest option. Win-win! If you absolutely need cash, use an ATM in your destination to withdraw the local currency with your debit card. This will help ensure you always get the best exchange rate anywhere you travel.

Related Posts

- Why Credit Card Travel Booking Portals Are Not Worth It

- 5 Cheap & Easy Countries to Get Permanent Residency

- Do Travel Websites Increase Prices Based on Your Search History?

- 5 Ways to Use Your Phone Cheap While Abroad

- 5 Ways to Avoid Paying Baggage Fees

Want more from The Global Gadabout? Sign up for the newsletter and get access to exclusive printable freebies!

Pin this post for later!