Credit card rewards points are a great way to score free travel. Yes, free travel! Check out my post Credit Card Points: A Beginner’s Guide for an introductory look at travel rewards credit cards, how they work, and what to look for when choosing a card.

Once you’ve chosen a rewards credit card, you have to maximize its benefit. It is very easy to get caught up in spending and racking up points and get in over your head. Failure to manage your rewards credit card property can neutralize the bonus and free money they can give you. In this post, I’m going to share with you five tips for getting the most out of whichever card you choose and avoiding major pitfalls.

1. Never Carry a Balance

Credit card companies make their money by charging you interest. Basically, they extend you a line of credit, a loan, and charge you in interest for every month you carry a balance, essentially not repaying the loan. Even if you get the huge number of introductory bonus points most cards offer, every month you carry a balance and pay interest, you eat into that free travel money. It’s very easy to completely nullify bonus points with a few months of paying interest.

So the best way to avoid this and maximize your benefit it to make sure you pay your card off in full every single month. Think of your credit card more like a debit card. You may have a $10,000 limit, but if you only have $1500 in the bank, you really only have a $1500 limit. Never spend more than you actually have. That way, you know you can pay it off completely when the bill comes and never accrue any interest.

2. Automatic Payment

The best way to be sure you never carry a balance is to set up automatic payment. Every time I open a new rewards credit card, the first thing I do (before even charging anything on it!) is to set up automatic payment. You can log in to your account online and set it up to automatically pay out of your bank account every month.

You can set it to pay off the minimum amount, any other set amount you choose, or the entire card balance. I highly recommend you set it to pay off the card balance in full automatically each month. If you are being careful and, as I suggested previously, never spending more than you have in the bank, this effectively turns your credit card into a debit card. Whatever you charge on it is automatically coming out of your bank account (albeit on a delay, only being deducted once a month instead of immediately).

Once you set up automatic payment, you never have to worry about forgetting to pay off your credit card bill either. I’ve found this to be hugely helpful when traveling. I never have to think about finding a secure internet connection to pay off my card when I’m in an unfamiliar country, or remembering to do it around travel plans.

This also means you will never incur any late fees, which can quickly eat into the benefit of your points. Just be careful with autopay taking that monthly payment off your radar that your bank balance is always more than your credit card balance so that you do not incur overdraft fees. If you can do this, you never have to even think about your credit card payments and it makes racking up points with a rewards credit card very easy.

3. Spending Money Without Spending Money

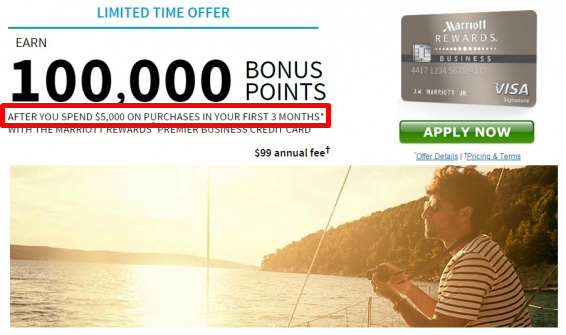

The best way to get a ton of points (and thus free travel) quickly, is to take advantage of credit card companies’ sign up bonuses. Most will give you 30,000, 50,000, even 100,000 bonus points if you use their card to spend, say, $3000, $4000, or $5000 in the first three months. For a frugal budget traveler like me, I sometimes find it difficult to spend that amount of money that quickly. In order to get the bonus, I sometimes have to come up with tricky ways to spend money on the card without actually spending money from my bank account.

There are two main ways that I do this. The first may not work for everyone, but can really help you rack up points quickly. It’s very simple. Ask your family and friends if you can pay some of their expenses with your card. If someone you know is making a big purchase, ask to put it on your card and have them pay you back. Or see if you can put someone else’s monthly bills on your card for one month to drive up that initial spending.

Even little things can add up. When you go out to dinner and plan to split the check, instead of splitting it at the restaurant, put the whole thing on your card and get your dinner partner to give you cash or Venmo their portion to you. Utilize your loved ones to help you “spend” more.

The second way to spend without actually spending is a method you don’t need anyone else for. Use your credit card to purchase gift cards or other prepaid credit cards. In essence, you are spending money on your credit card, but spending on a way to save it and use it later. If you shop at particular stores regularly but don’t plan to spend enough there before your time is up to get that bonus offer, buy a gift card. This way you “spend” money, but delay actually spending it until you need it in the future.

If you don’t have particular stores you like to shop at, you can also buy a generic prepaid credit card to use wherever you want in the future. These often have a $5 or so activation fee, but this is a minimal amount to spend in order to get the $200 to $600 in free travel rewards points that most bonus offers grant you.

Visa Gift Card

4. Redeem for the Best Benefit

Once you’ve collected a whole bunch of points and hopefully achieved that bonus threshold, it’s time to start redeeming them. Depending on the card, there are a few tricks to redeem your points for the best benefit. If your card has a minimum number of points you need to have in order to redeem them, try to use them for purchases that are as close as possible to the total value of your points. If you have $500 worth of rewards points, for example, try to use them for something as close to $500 as possible.

If that card has a minimum of $100 worth of points needed in order to redeem, say, and you use them for something worth $415, you are leaving $85 worth of travel unable to be used until you have accrued enough points to get back over that $100 minimum. Without the big sign-up bonus, it can take a while to build points back up. If you plan to keep the card long term this might not be a problem, but if you are like me and jump around from card to card racking up those huge sign-up bonus point offers, this is not maximizing the free travel potential of rewards credit cards.

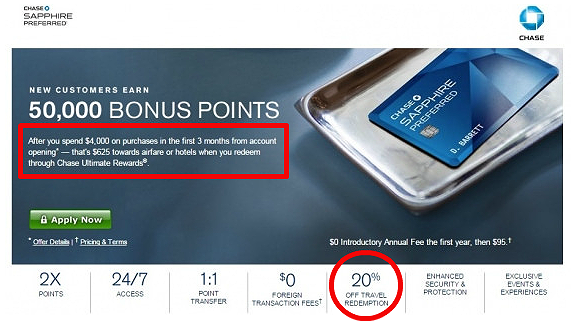

The other trick to keep in mind is checking if your card rewards you for using your points in specific ways. Some cards offer you a higher value for your points if you use them to purchase travel through their system. Redeeming points on a Chase card, for example, for cash back or gift cards gives your the standard $1 per 100 points value. But if you use them to buy flights or hotels through their online system, they give you 20% off. So 50,000 bonus points is worth $500 in cash or gift cards, but $625 in travel purchases. If you don’t use it in the best way, you just leave money on the table.

5. Timing & Canceling

My last trick for maximizing your rewards credit card is to keep an eye on your timing. Only apply for a new card when you know you will be able to achieve the required spending minimum for the bonus sign-up offer. That’s really where you get the big free travel benefit, and is really the main advantage of travel rewards credit cards for budget travelers. Don’t apply for multiple cards at the same time unless you know you will have expenses enough to get the bonus offer for both.

The other thing to keep in mind is annual fees. Most cards have an annual fee. This might range from something like $75 all the way up to $400 or $500! A lot of credit card companies try to hook you by waiving this fee for the first year. They are banking on the fact that you will either like their card and want to keep it, or that you will forget about the fee coming up a year later until it’s already been charged. To avoid paying annual fees on those cards that waive the first year, be sure to use your points and cancel the card before the first year is up. Of course, if you are getting a lot of points and the annual fee isn’t too big, it might just be worth it to pay the fee and keep the card. But as a low-budget traveler, I have never personally found this to be the case.

So from setting up your card to how you use it, accruing points quickly and spending them well, and, of course, avoiding fees, I hope you find these tips helpful. When used wisely, rewards credit cards are a fantastic way to travel hack and explore the world for free!

*This post includes one or more affiliate links. I earn a small commission (at no extra cost to you!) if you purchase a product or service through one of these links. Find out more here.*

Pin this post for later!